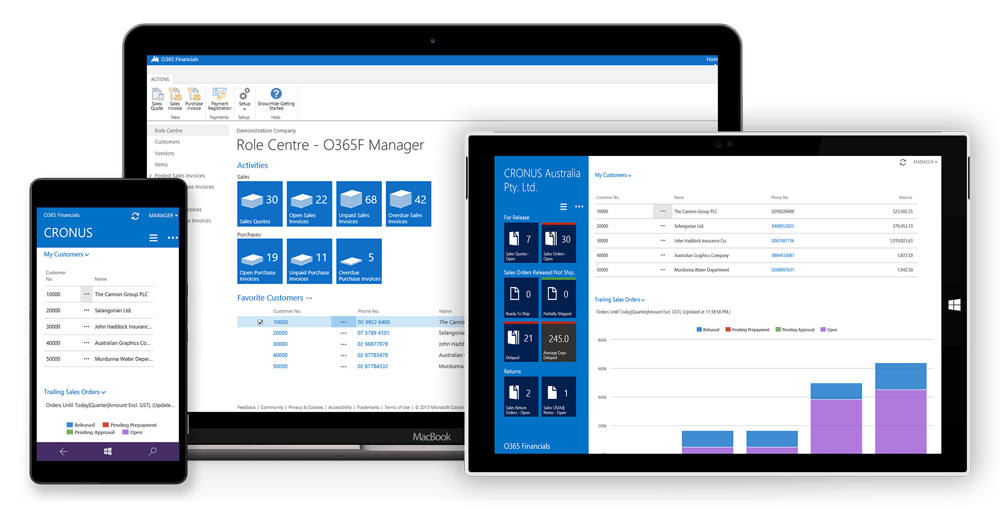

Financial Management

Transform your financial management with Microsoft Business Central's powerful financial module. Seamlessly integrate all your financial operations, from accounting to budgeting, into one centralized platform. Gain real-time insights, make informed decisions, and drive business growth with robust features like automated bookkeeping, intelligent reporting, and streamlined cash flow management. Say goodbye to manual tasks and hello to increased efficiency, accuracy, and profitability. Discover the future of financial management with Microsoft Business Central today.The chart of accounts lists all the accounts used to post transactions to the general ledger. It contains balance sheet accounts and income statement accounts. In adding to default setup, in the chart of amounts you can use advanced features for VAT or tax processing. The user can create custom general ledger accounts that can be used in sales and purchase documents, general journals to post transactions in the general ledger. It is also possible to define dimensions that are used to add values in entries to ensure more accurate reporting.

Dimensions In Dynamics 365 Business Central, dimensions are used in advanced financial analyses. Once dimensions are set up, you can allot default dimensions to customers, items, vendors, G/L accounts, jobs, resources and many more. For each dimension defined, you can create multiple dimension values. For example, before a sales transaction is posted, you can assign a customer group dimension to a sales document. While posting expenses, a department can be assigned to enable the analysis and comparison of expenses based on departments.

Cash Flow Forecast To obtain a better overview of cash availability, companies need better cash flow forecasting. The cash flow forecast functionality in Dynamics 365 Business Central has been designed to calculate projected cash flows including many cash sources such as receivables, payments, sales, and purchase orders. Using expense and revenue data, the system analyses the potential impact of planned loans or investment. With embedded Cortana Intelligence, the system generates cash flow forecasts using machine learning based on historical revenues and expenses.

Budgets The budget features are available for general ledger accounts, costs, sales, and purchases.

Deferrals In the system, it is possible to describe deferral templates to automate the deferral settlement process for revenues and expenses within a predefined schedule.

Dimensions In Dynamics 365 Business Central, dimensions are used in advanced financial analyses. Once dimensions are set up, you can allot default dimensions to customers, items, vendors, G/L accounts, jobs, resources and many more. For each dimension defined, you can create multiple dimension values. For example, before a sales transaction is posted, you can assign a customer group dimension to a sales document. While posting expenses, a department can be assigned to enable the analysis and comparison of expenses based on departments.

Cash Flow Forecast To obtain a better overview of cash availability, companies need better cash flow forecasting. The cash flow forecast functionality in Dynamics 365 Business Central has been designed to calculate projected cash flows including many cash sources such as receivables, payments, sales, and purchase orders. Using expense and revenue data, the system analyses the potential impact of planned loans or investment. With embedded Cortana Intelligence, the system generates cash flow forecasts using machine learning based on historical revenues and expenses.

Budgets The budget features are available for general ledger accounts, costs, sales, and purchases.

Deferrals In the system, it is possible to describe deferral templates to automate the deferral settlement process for revenues and expenses within a predefined schedule.

Process Payments

Dynamics 365 Business Central updates payment processing. Payments are managed on the page where they were entered. With just a few clicks, you can mark your invoices as paid, and then run automated account reconciliation. In addition, payments for vendors are settled in the payment journal that comprises advanced features such as vendor priority setup and payment due dates. Payment reconciliation is processed by running the suggested vendor payments batch. If necessary, you can also amend the payment journal lines and then make payments electronically or by check. In the payment journal, you can simultaneously process and reconcile bank statement transactions. The only thing you need is to import bank statement files and the system will automatically settle transactions, applying all the advanced rules you have set up.

Fixed Assets By keeping track of fixed assets transactions, such as acquisitions, depreciations, write-downs, appreciations, and disposals, you gain a comprehensive and up-to-date overview of your fixed assets.

Bank Account Management Dynamics 365 Business Central supports diverse business needs and across different currencies, enabling users to create and manage multiple bank accounts.

Audit Trails Dynamics 365 Business Central automatically assigns audit trails and transaction posting descriptions. Furthermore, users can set up custom reason codes to create additional audit trails.

Fixed Assets By keeping track of fixed assets transactions, such as acquisitions, depreciations, write-downs, appreciations, and disposals, you gain a comprehensive and up-to-date overview of your fixed assets.

Bank Account Management Dynamics 365 Business Central supports diverse business needs and across different currencies, enabling users to create and manage multiple bank accounts.

Audit Trails Dynamics 365 Business Central automatically assigns audit trails and transaction posting descriptions. Furthermore, users can set up custom reason codes to create additional audit trails.